Portfolio Impact & Returns Analysis for 120878323, 46819551, 1903919817, 649776232, 914842500, 1422746204

The portfolio impact and returns analysis for identifiers 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204 presents a comprehensive evaluation of performance metrics and associated risk profiles. By comparing actual returns to established benchmarks, one can discern the effectiveness of current investment strategies. This examination raises critical questions about adaptability and decision-making in the face of market volatility, setting the stage for strategic insights that could reshape future investment approaches.

Overview of Portfolio Identifiers

Portfolio identifiers serve as critical metrics for assessing and managing investment portfolios. They enable investors to evaluate portfolio diversification and align with specific investment strategies.

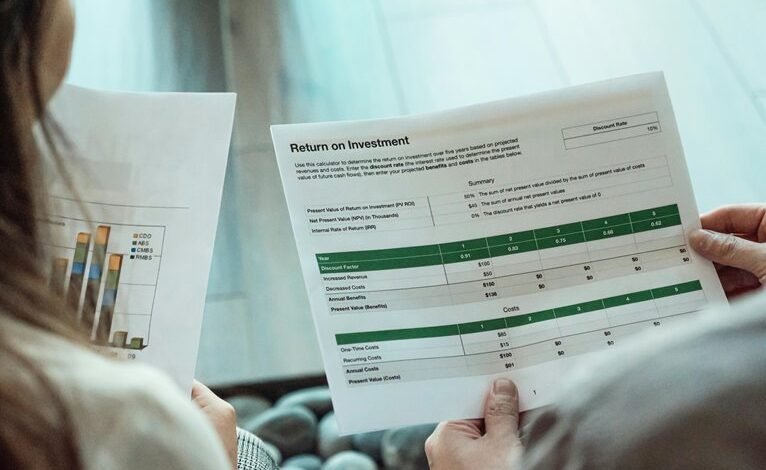

Performance Metrics Analysis

Evaluating performance metrics is essential for understanding the effectiveness of investment strategies within a portfolio. By comparing returns against established performance benchmarks, investors can gauge investment efficiency.

Key metrics such as the Sharpe ratio and alpha provide insights into risk-adjusted returns, enabling investors to assess whether their portfolio aligns with desired financial outcomes. This analysis empowers informed decision-making and strategic adjustments.

Risk Profiles Assessment

Understanding performance metrics lays the groundwork for a comprehensive risk profiles assessment, which is vital for aligning investment strategies with individual risk tolerance levels.

A rigorous risk tolerance evaluation, coupled with a detailed volatility assessment, allows investors to identify their capacity for market fluctuations.

This analysis fosters informed decision-making, thereby empowering individuals to navigate the complexities of investment landscapes with greater confidence and control over their financial destinies.

Strategic Insights and Recommendations

While market dynamics are inherently unpredictable, leveraging strategic insights can significantly enhance investment outcomes.

Analyzing current market trends reveals opportunities for diversification and risk mitigation. Investors should adopt adaptable investment strategies that align with evolving economic conditions, ensuring responsiveness to shifts in market sentiment.

Implementing data-driven approaches facilitates informed decision-making, empowering investors to navigate complexities while pursuing optimal returns and maintaining autonomy in their investment journeys.

Conclusion

In conclusion, while the portfolio impact and returns analysis for identifiers 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204 indicates a need for strategic adaptability, one might wonder if the true secret to financial success lies in the art of guessing rather than data-driven analysis. Ultimately, as investors cling to their meticulously crafted strategies, they may find that fortune favors the reckless, leaving the analytical minds to ponder the irony of their own caution.